A Practical Guide to Commercial Due Diligence

A major investment or acquisition requires looking beyond the balance sheet. While financial data tells you a company’s past performance, commercial due diligence assesses its future viability. It’s the investigative work that digs into a company’s market position, competitive strength, and genuine growth prospects.

This process is the difference between buying a car based on its polished exterior and performing a thorough inspection of the engine and transmission to ensure long-term performance.

What Is Commercial Due Diligence?

Imagine acquiring a successful restaurant. Financial due diligence confirms its reported profits. Commercial due diligence (CDD) asks the strategic questions that determine if those profits are sustainable.

It investigates external factors: Is the neighborhood’s economic outlook positive, or will new infrastructure divert traffic? It assesses the market: Is the food genuinely superior, or does the restaurant lack competition? It uncovers threats: Is a well-funded competitor planning to open nearby?

CDD provides a rigorous, evidence-based assessment of a company’s business plan and its position within its market.

Validating the Business Model

At its core, commercial due diligence pressure-tests the assumptions underlying an investment thesis. It examines the external market forces and internal operational realities that financial statements alone cannot capture. The objective is to form an unbiased view of a company’s future potential by evaluating its ability to sustain a true competitive advantage.

This process moves beyond historical performance to determine if the business is built for long-term success.

Core Goals of Commercial Due diligence

The investigation focuses on three key objectives. When combined, these analyses provide a comprehensive picture of the target company’s commercial health.

- Assess Market Health and Opportunity: This involves analyzing the total addressable market (TAM), its growth rate, and influential trends. The goal is to determine whether the company operates in an expanding, stagnant, or declining industry.

- Understand the Competitive Landscape: This analysis identifies key competitors, evaluates their strengths and weaknesses, and determines the target’s defensible market share. It seeks to define the company’s “moat”—its unique, sustainable competitive advantage.

- Confirm Customer Loyalty and Revenue Quality: This step scrutinizes customer relationships to identify risks such as high concentration (over-reliance on a few key clients). It involves analyzing customer satisfaction data and churn rates to assess the stability and predictability of the revenue stream.

A company might show strong revenue growth, but CDD could reveal that 80% of that revenue comes from a single client with a contract expiring in six months. This is a critical risk that only a thorough CDD process is designed to uncover.

Ultimately, this process provides investors and acquirers with the confidence that the target’s strategic narrative aligns with market reality. It connects the financial past to the strategic future, ensuring an investment is built on a solid foundation.

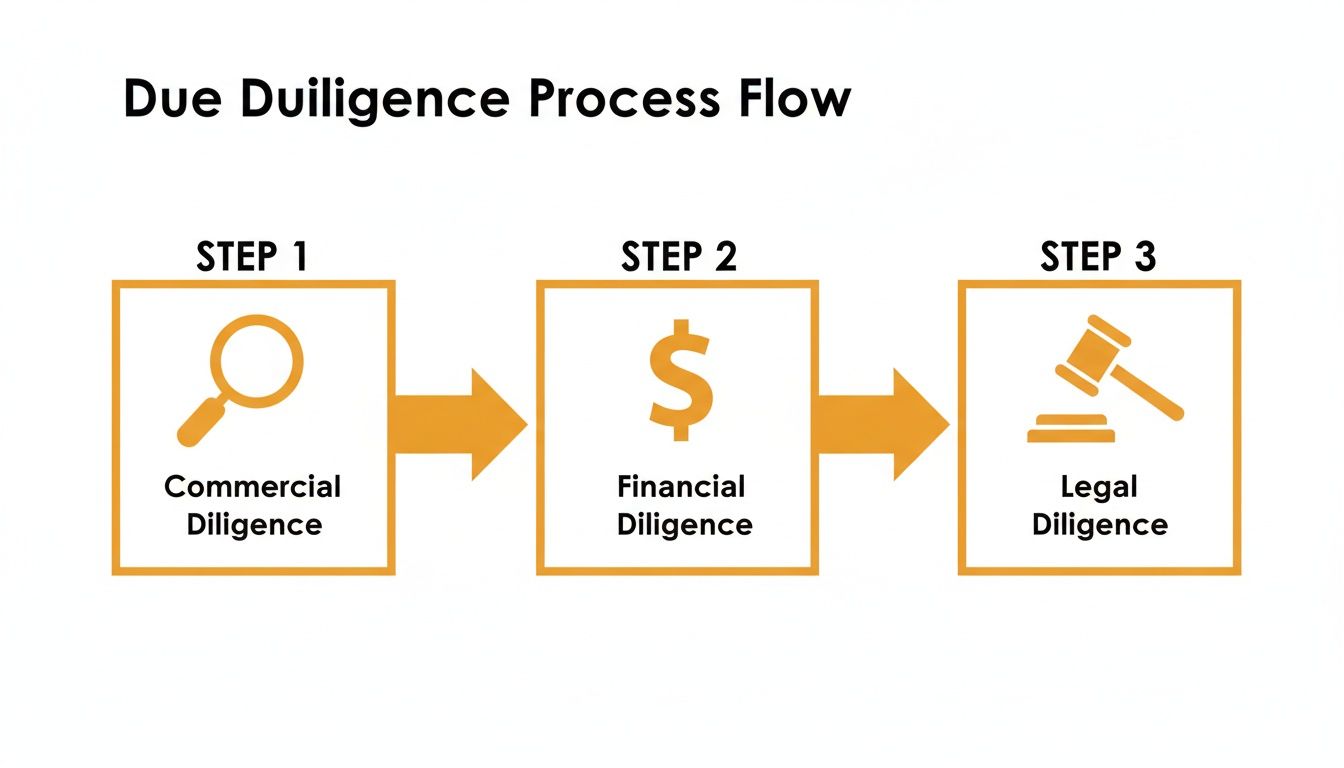

How CDD Fits with Other Diligence Types

A major transaction requires a comprehensive evaluation, with each diligence type providing a unique perspective. Commercial due diligence (CDD) is a critical component that works alongside financial, legal, and operational diligence to create a 360-degree view of the target company.

Making a decision without input from all four areas is like purchasing a property based solely on photographs; it exposes the buyer to significant and avoidable risks.

Consider the analogy of buying a house, where each diligence type serves as a specialized inspection:

- Financial Due Diligence is the appraiser, verifying the asset’s value and historical income.

- Legal Due Diligence is the title search, ensuring there are no hidden liens, ownership disputes, or zoning violations.

- Operational Due Diligence is the home inspector, examining the foundation, wiring, and plumbing for structural flaws.

Commercial due diligence addresses the strategic, forward-looking questions. Is the surrounding neighborhood appreciating or declining in value? How does this property compare to others on the market? What is the five-year outlook for its value? CDD focuses on the market, competition, and future potential.

The Four Pillars of Diligence

Each of these pillars answers distinct questions and delivers unique insights. Crucially, the findings from one area can directly contradict another. A company might have excellent financials, but commercial diligence could reveal an imminent market disruption from a new competitor, threatening its entire customer base. A strong balance sheet is of little value without a defensible market position to sustain it.

While each area requires a deep dive, understanding their interplay is key. For a more detailed look, you can explore a complete vendor due diligence checklist that breaks down these components further.

Commercial due diligence provides the strategic “why” behind the numbers. It’s the difference between knowing a business is profitable today and understanding if it can remain profitable over the next five to ten years.

A successful acquisition depends on integrating the findings from all four pillars. Neglecting one area creates exposure to risks that should have been identified and mitigated.

Comparing the Four Pillars of Due Diligence

The table below clarifies the distinct focus of each diligence type, showing how each contributes to a comprehensive evaluation before a transaction is finalized.

| Diligence Type | Primary Focus | Key Questions Answered | Example Deliverable |

|---|---|---|---|

| Commercial | Market Viability & Growth | Is the market growing? Who are the customers and competitors? Is the business model sustainable? | Market Analysis Report, Competitive Landscape Study, Customer Reference Interviews |

| Financial | Financial Health & Accuracy | Are the financial statements accurate? Is cash flow sustainable? What is the quality of earnings? | Quality of Earnings (QoE) Report, Financial Projections Validation, Debt & Equity Analysis |

| Legal | Compliance & Liabilities | Are there pending lawsuits? Is intellectual property protected? Are all contracts valid and enforceable? | Legal Compliance Audit, Contract Review Summary, Intellectual Property Report |

| Operational | Efficiency & Scalability | Can the business scale effectively? Are the internal processes efficient? What are the key operational risks? | Operational Scalability Assessment, Technology Stack Review, Supply Chain Analysis |

Each of these reports is a vital input for the final investment thesis. Commercial due diligence acts as the primary reality check, ensuring a company’s claims about its market opportunity and growth are substantiated by evidence.

A Step-By-Step Commercial Due Diligence Framework

Effective commercial due diligence follows a structured, repeatable playbook. A clear framework transforms a potentially chaotic investigation into a focused analysis, providing a reliable method to validate a target’s business model.

This process serves as the initial strategic filter. As the chart illustrates, insights from commercial due diligence provide essential context for the financial and legal reviews that follow.

Without this initial deep dive, subsequent financial and legal analyses lack critical context.

1. Market and Competitive Analysis

The first step is a macro-level analysis of the target’s operating environment. This goes beyond market size to understand the industry dynamics that will either support or hinder its growth. The goal is to validate the company’s narrative about its market opportunity and competitive positioning.

- Market Size and Growth: Define the total addressable market (TAM) and its trajectory. Is the industry growing, shrinking, or consolidating?

- Competitive Moats: Identify the company’s sustainable competitive advantages. Is it proprietary technology, brand equity, exclusive partnerships, or first-mover advantage?

- Industry Trends: Analyze macro shifts—such as new technologies, regulations, or consumer behaviors—that could impact the target’s business model.

2. Customer Analysis

Next, focus on the company’s most critical asset: its customers. This stage assesses the quality and stability of the revenue base by analyzing customer data and conducting direct interviews. Key areas of investigation include customer feedback, churn rates, and revenue concentration.

A common mistake is to rely solely on the target’s claims of customer satisfaction. Independent verification through direct customer interviews is essential for uncovering the true state of customer loyalty and identifying potential issues.

The objective is to determine if the customer base represents a solid foundation for growth or a significant risk. Actionable items include identifying customer concentration (does any single client account for more than 10-15% of revenue?), measuring Net Promoter Score (NPS), and analyzing churn and retention metrics.

3. Go-To-Market Strategy Review

A strong product or service is ineffective without an efficient sales and marketing engine. This part of the process evaluates the scalability and effectiveness of the target’s go-to-market strategy.

The review should analyze the core operations of the sales and marketing functions:

- Sales Process Efficiency: Measure the sales cycle length, conversion rates at each funnel stage, and customer acquisition cost (CAC).

- Marketing ROI: Identify which marketing channels generate qualified leads and calculate the return on marketing investment.

- Channel Strategy: Assess the effectiveness of the current sales channels, whether direct, partner-led, or online.

4. Product and Service Viability

This step evaluates the core offering. Does the product or service solve a critical customer problem more effectively than alternatives? This requires an objective assessment of the value proposition.

This is also where you test the company’s pricing power—its ability to increase prices without significant customer attrition. Strong pricing power is a clear indicator of a powerful value proposition and a defensible competitive advantage. To establish a baseline, you can review typical hourly IT consulting rates and pricing structures.

5. Operational Scalability

An attractive business model must be operationally scalable. This step determines if the company’s processes, technology, and team can support significant growth.

Key questions include: Can the technology stack handle 10x the current workload? Does the service delivery model have single points of failure that pose a risk to operations?

6. Management Team Assessment

A business plan is only as strong as the team executing it. This final step involves evaluating the leadership’s experience, track record, and strategic vision. This requires in-depth interviews and background analysis to determine their capability to navigate future challenges.

The market for due diligence services reflects the critical importance of this structured approach. The overall market was valued at USD 12.65 billion in 2024 and is projected to reach USD 20.66 billion by 2032. The commercial due diligence segment is growing even faster, from USD 1.971 billion in 2023 to a projected USD 2.782 billion by 2031, highlighting its essential role in modern strategic decision-making.

Critical Metrics and Red Flags to Look For

During commercial due diligence, success depends on identifying and interpreting the right metrics. It is necessary to move beyond high-level presentations to dissect the core data points that reveal a company’s true operational health.

These metrics function as the business’s vital signs, telling a story that is not always apparent from a standard profit and loss statement.

Decoding the Most Important Metrics

While specific KPIs vary by industry, several are universally critical for evaluating a company’s business model.

The three most critical metrics include:

- Customer Acquisition Cost (CAC): The total cost to acquire a new customer. A low and stable CAC indicates an efficient sales and marketing function. A rapidly increasing CAC can be a red flag, suggesting market saturation or inefficient marketing spend.

- Customer Lifetime Value (CLV): A projection of the total revenue a business can expect from a single customer account. A high CLV demonstrates customer loyalty and strong product-market fit, indicating that the company is effective at retaining and expanding its customer relationships.

- Net Revenue Retention (NRR): This metric measures recurring revenue from existing customers over a specific period, accounting for both churn and expansion revenue. An NRR over 100% is a key indicator of a healthy, scalable business, as it signifies growth from the existing customer base alone.

A sustainable business model typically demonstrates a CLV significantly higher than its CAC. A common benchmark is a CLV:CAC ratio of 3:1 or greater. This indicates that for every dollar invested in customer acquisition, the company generates at least three dollars in lifetime value, signaling profitable growth.

Spotting Commercial Due diligence Red Flags

Identifying warning signs is as important as analyzing positive metrics. These red flags often lie beneath the surface and are uncovered through qualitative investigation rather than financial statement analysis.

Ignoring these issues can lead to significant problems post-acquisition. Be vigilant for these common indicators of underlying business weakness:

- High Customer Concentration: If a single client or a small number of clients account for a disproportionate share of revenue (e.g., over 20%), the business has a significant risk exposure. The loss of one of these accounts could have a catastrophic impact.

- A History of Missed Forecasts: A pattern of failing to meet projected targets suggests poor strategic planning, a misunderstanding of the market, or fundamental operational weaknesses.

- Declining Market Share in a Growing Market: If the overall industry is expanding but the company’s market share is shrinking, it is a strong indicator that competitors are outperforming it.

- Weak Competitive Differentiation: If the company cannot clearly and concisely articulate its unique value proposition, it may lack a defensible competitive advantage. A true “moat” should be specific, difficult to replicate, and valued by customers.

The demand for this level of detailed analysis is growing rapidly. The global market for commercial due diligence services was valued at USD 601 million in 2025 and is projected to more than double to USD 1,209 million by 2031. You can read the full research about this expanding market and its key drivers. This growth confirms that scrutinizing these metrics and red flags is now a mandatory component of sound investment strategy.

Assembling Your Commercial Due Diligence Team

A successful commercial due diligence process requires a team with a diverse skill set. Whether forming an internal task force or engaging external experts, the right combination of expertise is essential to uncover meaningful insights.

A well-structured team ensures a comprehensive analysis, covering everything from high-level market trends to the details of customer satisfaction.

Defining Core Team Roles

While individuals may serve multiple functions on smaller deals, the core responsibilities remain constant. The objective is to combine quantitative data analysis with qualitative, real-world intelligence. Here are the four essential roles for any CDD team:

- The Deal Lead (The Quarterback): This individual manages the entire diligence process. They define the scope, coordinate team members, and synthesize all findings into a coherent investment thesis. Their primary responsibility is to ensure the final report provides clear, actionable answers to key strategic questions.

- The Market Analyst (The Data Detective): This role focuses on quantitative analysis. The analyst investigates market reports, assesses the competitive landscape, and identifies growth drivers. Their work provides the critical macro-level context for the entire investigation.

Gathering On-the-Ground Intelligence

Data rooms and financial models provide only part of the story. To truly understand a company’s commercial health, it is necessary to engage directly with its customers and with industry experts who possess deep market knowledge.

The most valuable insights in commercial due diligence often come from primary research, not secondary data. Direct conversations with customers and subject matter experts are critical for uncovering the story behind the numbers.

This is where the next two roles become indispensable:

- The Customer Interviewer (The Investigative Journalist): This individual conducts structured, unbiased interviews with the target’s key customers. Their goal is to validate claims about customer loyalty, identify pain points, and assess the strength of the company’s value proposition from the customer’s perspective.

- The Subject Matter Expert (The SME): The SME provides deep, domain-specific industry knowledge. When evaluating a cloud partner, for example, an SME familiar with specialized it consulting services can identify subtle risks or opportunities that a generalist would miss. Understanding the different types of IT consulting services demonstrates the level of expertise required. The SME provides the essential “so what?” context to the analyst’s findings.

The Future of Commercial Due Diligence

Commercial due diligence is not a static discipline. It is continually evolving in response to new technologies and shifting investor priorities. The process is transitioning from a retrospective validation exercise into a predictive, forward-looking strategic tool.

Advanced data analytics and AI are enabling this shift. A modern CDD process can now model various market scenarios and forecast customer behavior with greater accuracy, transforming diligence from a simple risk-mitigation step into a powerful component of strategic planning.

The Rise of Predictive Analytics

Technology now enables deal teams to analyze vast datasets, uncovering subtle trends and risks that were previously invisible. This data-first approach provides a more granular and nuanced understanding of a company’s competitive position.

Market adoption reflects this trend. Nearly 49% of firms are integrating advanced data analytics into their diligence processes, while 52% are expanding their services to manage the complexities of cross-border transactions. This is a direct response to investor demand for faster, deeper insights. You can explore more market trend data and its impact.

ESG as a Core Diligence Pillar

Beyond technology, another significant shift is the integration of Environmental, Social, and Governance (ESG) factors into the core diligence framework. Once a peripheral concern, ESG is now central to assessing a company’s long-term value, operational resilience, and brand risk.

A strong ESG profile is no longer a “nice-to-have.” Investors now view it as a leading indicator of operational excellence, sophisticated risk management, and a company’s ability to attract top talent and maintain customer loyalty.

A poor ESG track record presents tangible financial risks, including regulatory penalties, supply chain disruptions, and reputational damage. Consequently, a comprehensive commercial due diligence process must now evaluate:

- Environmental Impact: Assess risks related to climate change, resource management, and pollution.

- Social Responsibility: Evaluate the company’s labor practices, community relations, and data privacy policies.

- Governance Quality: Analyze the board structure, executive compensation, and ethical standards.

Integrating these evolving standards ensures that your diligence process is robust not only for today’s market but also for the challenges and opportunities of the future.

Your Top Questions About CDD, Answered

Even with a clear framework, questions often arise during a commercial due diligence project. Addressing these common inquiries can clarify the process and support confident decision-making.

How Long Does Commercial Due Diligence Take?

The timeline for commercial due diligence can range from a few weeks to several months, depending on the deal’s complexity, the size of the target company, and the accessibility of information.

For a typical mid-market transaction, a focused CDD process generally takes four to eight weeks from kickoff to the delivery of the final report.

What’s the Difference Between CDD and Market Research?

This distinction is critical. Market research is a component of commercial due diligence, but it is not the entire process.

Market research provides broad industry context—it defines the market size and identifies key players. CDD uses this market data as a starting point but goes further to conduct a deep analysis of one specific company within that market. CDD synthesizes market data, customer interviews, competitive intelligence, and an assessment of internal capabilities to form a complete, actionable investment thesis.

Can We Just Do CDD In-House?

An in-house team can conduct CDD, particularly if it possesses deep industry expertise and strong analytical capabilities. An internal team has the advantage of understanding the parent company’s strategic objectives.

However, engaging a third-party consultant often provides significant benefits. An external firm offers an unbiased perspective, free from internal politics or preconceived notions about the deal. Consultants also bring specialized frameworks, proprietary data sources, and extensive experience from previous engagements.

The most common pitfall in due diligence is ‘confirmation bias’—the tendency to seek out data that supports a pre-existing belief that the deal is a good one. A robust process actively seeks to disprove the initial investment thesis.

Engaging an external expert is an effective strategy for mitigating confirmation bias. It ensures a rigorous, objective assessment of both the opportunities and the risks, pressure-testing the deal’s assumptions to confirm its strategic and financial merit.

Choosing the right cloud consulting partner is a big decision that demands its own rigorous diligence. CloudConsultingFirms.com gives you the independent, data-driven insights you need, with over 2,400 reviews and verified certifications to guide you. Start making a more informed choice by exploring our 2025 guide at https://cloudconsultingfirms.com.