Consulting Firms Ranking: A Practical Guide to Vetting Cloud Partners

Choosing a cloud consulting partner is a high-stakes decision. The right firm accelerates your strategy on AWS, Azure, or GCP; the wrong one leads to budget overruns and technical debt. Standard consulting firms ranking lists often prioritize brand recognition over tangible performance, making it difficult for technical leaders to find partners aligned with specific project needs. This guide provides an actionable framework for your selection process.

Instead of generic lists, we analyze seven distinct platforms and reports, each offering a unique evaluation lens. Use these resources to identify partners matching your technical requirements, industry compliance needs, and budget constraints—from sub-$500K mid-market projects to large-scale enterprise migrations. Our analysis focuses on providing evergreen insights relevant for your 2026 planning and beyond.

This article offers a direct look at the best resources to build your shortlist, complete with screenshots and links. We cut through the noise to help you de-risk vendor selection and find a cloud consultant that delivers measurable business outcomes. You’ll understand where to find data-driven comparisons, expert analyst reviews, and peer-based ratings to make an informed decision.

1. CloudConsultingFirms.com: Best for Data-Driven, Actionable Shortlists

For technology leaders needing to find the right cloud consulting partner, CloudConsultingFirms.com provides a methodology-first platform designed to cut through marketing noise. It is an independent buyer’s guide for CIOs, CTOs, and engineering heads who require evidence-backed data to build a vendor shortlist for AWS, Azure, or Google Cloud projects. The platform’s value is its transparent, data-driven approach to creating a definitive consulting firms ranking, explicitly stating its findings are “Ranked by Research, Not Ad Spend.”

This resource aggregates and synthesizes a massive dataset, including over 2,400 verified customer reviews, official partner certifications, and documented project outcomes. This consolidation of qualitative and quantitative metrics offers a more reliable signal of a firm’s capabilities than traditional vendor marketing. It provides a structured, defensible foundation for a critical technology decision.

Key Differentiators and Practical Tools

CloudConsultingFirms.com empowers users with practical tools that accelerate the decision-making process. Rather than a static list, the platform offers an interactive and customizable research experience.

- Interactive Best-Fit Quiz: A 2-minute quiz helps users define project needs, budget, and platform preferences. The algorithm then surfaces a preliminary list of best-fit firms, saving hours of initial research.

- ROI Calculator: This tool allows procurement and finance leaders to model potential cost savings and efficiency gains from a cloud project, helping build a stronger internal business case with forecasted financial benefits.

- Granular Platform Filters: Users can immediately narrow their search to certified experts in AWS, Azure, or GCP. This is critical for teams with specific technical requirements or existing multi-cloud strategies.

These features are complemented by detailed firm profiles that include typical engagement rates, project timelines, and deep dives into industry-specific compliance strengths (such as HIPAA or FedRAMP). This detail makes it easy to compare the trade-offs between cost, speed, and specialized expertise.

Transparent Evaluation Framework and Budget Tiers

A major strength is the platform’s transparent evaluation framework. Each firm’s position in the consulting firms ranking is determined by a weighted score across eight key dimensions:

| Evaluation Criteria | Description |

|---|---|

| Partner Certifications | Official, verified credentials from AWS, Azure, and GCP. |

| Documented Outcomes | Evidence of successful project delivery and measurable results. |

| Verified Client Feedback | Aggregated scores and qualitative feedback from over 2,400 reviews. |

| Technical Specialization | Depth of expertise in specific areas like FinOps, security, or data/AI. |

| Price/Value Ratio | Benchmarked pricing ranges relative to the firm’s capabilities and outcomes. |

| Team Quality & Experience | Assesses the expertise and tenure of the consulting team. |

| Innovation & R&D | Commitment to emerging technologies and modern cloud practices. |

| Post-Migration Support | Quality and availability of ongoing management and optimization services. |

This methodology ensures the rankings are defensible and rooted in performance metrics. The platform also segments the market into budget tiers, enabling users to find a partner that aligns with their financial scale. It profiles boutique specialists for projects under $200K, mid-market firms for engagements between $100K and $600K, and enterprise-grade partners for transformations over $250K. Rankings are updated quarterly, and a “red flags” system highlights firms with consistently negative signals.

Practical Tip: Use the platform’s budget tier filters first to create a realistic list of potential partners. Cross-reference this list with your specific technical needs (e.g., “Azure data analytics”) to create a highly targeted and actionable shortlist in under an hour.

Pros and Cons

Pros:

- Independent, Methodology-Driven Rankings: Aggregates over 2,400 verified reviews, partner certifications, and project outcomes to minimize marketing influence.

- Actionable Decision Tools: The 2-minute quiz, ROI calculator, and platform-specific filters enable rapid, data-informed shortlisting.

- Full Market Spectrum Coverage: Includes boutique specialists (<$200K), mid-market firms ($100K–$600K), and enterprise partners ($250K–$1M+), with clear cost and expertise trade-offs.

- Transparent and Current Data: A clear evaluation framework and quarterly updates ensure the recommendations are reliable and defensible. For deeper insights, you can review their detailed analysis of cloud migration consulting companies on CloudConsultingFirms.com.

Cons:

- Pricing Is Estimated: The published pricing ranges are firm-level averages. Actual project quotes will vary based on scope and complexity, requiring direct RFPs for validation.

- Sponsored Visibility: Featured placements are paid and labeled. While the core scores remain independent, users should explore beyond the sponsored listings to avoid potential discovery bias.

Website: https://cloudconsultingfirms.com

2. Vault (Firsthand)

Vault, now part of Firsthand, is an established resource in the consulting industry, known for annual rankings that are closely watched by professionals. While many platforms focus on technical capabilities or client reviews, Vault’s strength lies in its deep dive into internal firm dynamics: prestige, culture, diversity, and employee satisfaction. This makes it a valuable tool for leaders who understand that engagement quality is directly tied to the talent and morale of the consulting team.

For CIOs, CTOs, and procurement teams, Vault provides a crucial, often overlooked, layer of due diligence. A firm with high prestige and a strong “Best to Work For” ranking is more likely to attract and retain top-tier talent, which translates into superior problem-solving and innovation. Vault’s consulting firms ranking system acts as a proxy for talent acquisition and retention success, giving you a signal about the quality of people you will be working with.

Key Features and How to Use Them

Vault’s platform is straightforward, with rankings categorized for easy navigation. You can explore firms through multiple lenses for a nuanced evaluation.

- Regional Rankings (North America, EMEA, APAC): Use these lists to create a geographically relevant shortlist, ensuring consultants have local market knowledge and can provide on-the-ground support.

- Practice Area Rankings: Filter by specific needs like IT Strategy or Cloud Consulting to identify firms with recognized expertise in your project’s domain.

- Purchasable Guides: For a nominal fee (around $34.95), download detailed digital guides offering deeper insights into firm culture, interview processes, and training programs.

Practical Tip: When shortlisting partners, cross-reference a firm’s high ranking in a technical category (like cloud) with its position on Vault’s “Best Firms to Work For” list. A strong showing on both indicates a firm with the right skills and a stable, motivated workforce, reducing your risk of project disruption from high consultant turnover.

While these rankings provide valuable context, they shouldn’t replace technical due diligence. For a deeper look into firms specifically vetted for cloud projects, explore specialized lists like the best cloud migration companies.

Platform Assessment

| Feature | Rating | Details |

|---|---|---|

| Data Quality | ★★★★☆ | Based on extensive surveys of verified consultants; strong for culture and prestige metrics. |

| Ease of Use | ★★★★★ | The website is clean and intuitive. Finding topline rankings is fast and requires no login. |

| Cost | ★★★★★ | Free access to all primary rankings. Detailed guides are very affordable. |

| Focus | ★★★★☆ | Excellent for talent, culture, and prestige. Less focused on technical client outcomes or ROI. |

Pros & Cons:

- Pro: Recognized brand among consultants acts as a reliable indicator of a firm’s ability to attract top talent.

- Pro: Affordable, detailed guides provide a low-cost way to gather qualitative intelligence on potential partners.

- Con: High prestige or a good work culture doesn’t automatically guarantee superior client delivery or technical execution.

- Con: Coverage can be more extensive for larger, more established firms, with less detail on smaller or niche boutiques.

Official Website: https://vault.com/best-companies-to-work-for/consulting

3. Forbes

Forbes, in partnership with Statista, provides a widely cited annual ranking in the consulting industry. Its distinction comes from a methodology that combines two critical perspectives: peer reviews from other consultants and direct feedback from clients. This dual-source approach offers a balanced view of a firm’s market reputation, making it a powerful initial screening tool.

For CIOs and CTOs, the Forbes list of “America’s Best Management Consulting Firms” serves as a high-level market perception signal. A firm’s presence and star rating reflect its overall brand strength and the frequency of recommendations it receives. This is useful for gauging a firm’s credibility and perceived expertise across industries and functional areas before diving into deeper technical evaluations. The comprehensive consulting firms ranking provides a broad snapshot of the competitive landscape.

Key Features and How to Use Them

Forbes presents its rankings in a clean, accessible list format that is easy to filter. This simplicity allows for quick identification of top-performing firms relevant to your needs.

- Annual U.S. and Global Lists: Use the regional lists to identify major players in your primary market. The “America’s Best” list is especially useful for domestic projects.

- Industry and Functional Filters: This is the most powerful feature for tech leaders. You can filter the list to see top-rated firms in categories like IT Strategy, Cloud Consulting, or AI to narrow your focus to proven specialists.

- Star Rating System: The five-star system indicates how frequently a firm was recommended. A five-star “very frequently recommended” firm is a strong candidate for your initial longlist.

Practical Tip: Use the Forbes list to validate the market reputation of firms you discover through other channels. If a potential partner claims deep expertise in AI but is absent from Forbes’ AI category ranking, it’s a valid reason to probe deeper into their project history and client testimonials during the RFP process.

While Forbes excels at capturing market sentiment, it does not provide granular details on project outcomes or pricing. It’s best used as a starting point before moving to platforms that offer deeper qualitative or technical assessments.

Platform Assessment

| Feature | Rating | Details |

|---|---|---|

| Data Quality | ★★★★☆ | Strong methodology combining client and peer surveys, offering a balanced view of market perception. |

| Ease of Use | ★★★★★ | Extremely straightforward. The lists are public, free, and easy to browse and filter without a login. |

| Cost | ★★★★★ | Completely free to access all rankings and associated articles. |

| Focus | ★★★☆☆ | Excellent for high-level brand reputation and perceived expertise. Lacks deep technical, ROI, or pricing data. |

Pros & Cons:

- Pro: Strong brand recognition and a transparent, survey-based methodology add significant credibility.

- Pro: The ability to filter by both industry and functional area allows for targeted and relevant shortlisting.

- Con: The rankings are based on recommendations, not on objective analysis of technical capabilities or project delivery success.

- Con: Provides no insight into a firm’s pricing, engagement models, or the typical consultant profile you’ll work with.

Official Website: https://www.forbes.com/lists/best-management-consulting-firms/

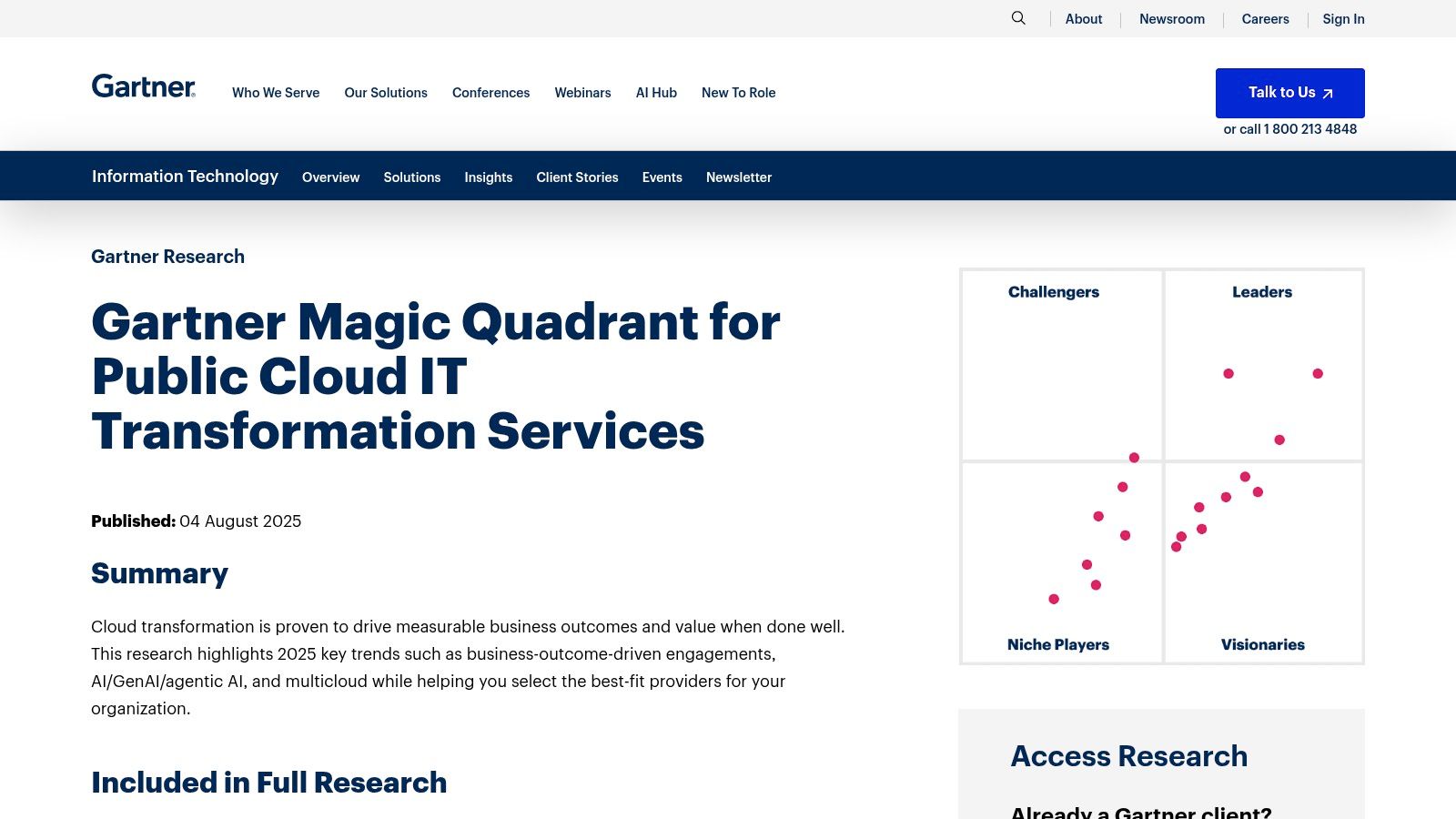

4. Gartner

Gartner is a heavyweight in technology research, and its Magic Quadrants are a cornerstone of enterprise vendor evaluation. Unlike platforms focused on employee sentiment, Gartner provides a rigorous, market-facing assessment of a consulting firm’s capabilities within specific domains like Public Cloud IT Transformation. This makes it an indispensable resource for CIOs, CTOs, and procurement leaders aiming to de-risk significant technology investments.

For leadership teams, a firm’s position within a Gartner Magic Quadrant serves as a powerful validation of its market execution and strategic vision. It provides an immediate, visual shortlist of providers categorized as Leaders, Challengers, Visionaries, or Niche Players. This framework helps you quickly understand which firms are established, innovating, or specialized, streamlining the initial stages of your partner selection process.

Key Features and How to Use Them

Gartner’s value lies in the depth and structure of its analysis, which provides actionable intelligence for vendor due diligence.

- Visual Magic Quadrant Positioning: Use the quadrant graphic to quickly segment the market. “Leaders” are generally safe bets for large-scale projects, while “Visionaries” might offer more innovative solutions for forward-thinking initiatives.

- Detailed Vendor Strengths and Cautions: This is the core of the report. For each vendor, Gartner outlines specific strengths (e.g., strong multicloud capabilities) and cautions (e.g., limited presence in APAC). Use this information to inform your RFP questions and scorecards.

- Domain-Specific Coverage: Reports are highly focused, such as the “Magic Quadrant for Public Cloud IT Transformation Services.” Ensure you are referencing the correct report for your specific need.

Practical Tip: During vendor negotiations, reference a firm’s “Cautions” from the Gartner report. Use these documented weaknesses as leverage to request specific service level agreements (SLAs), dedicated senior resources, or risk mitigation plans, turning a generic evaluation into a tool for strengthening your contract.

While Gartner’s analysis is robust, it’s essential to understand the criteria they use. You can get more insight into how these formal methodologies shape industry rankings.

Platform Assessment

| Feature | Rating | Details |

|---|---|---|

| Data Quality | ★★★★★ | Based on rigorous, structured methodology, vendor briefings, and client interviews. Highly respected in the enterprise. |

| Ease of Use | ★★★☆☆ | The quadrant is intuitive, but navigating the full platform and finding specific reports can be complex without a subscription. |

| Cost | ★★☆☆☆ | Full access is expensive and typically requires an enterprise subscription. Non-clients must rely on vendor-reprinted copies, which can be limited. |

| Focus | ★★★★★ | Unparalleled focus on enterprise-level vendor capabilities, market execution, and strategic vision. |

Pros & Cons:

- Pro: Widely respected by executive boards and procurement, providing strong third-party validation for your vendor choice.

- Pro: The “Cautions” section for each provider is invaluable for identifying potential risks and informing due diligence.

- Con: The high cost of a full Gartner subscription makes it inaccessible for many mid-market businesses.

- Con: The focus is on large enterprise providers; smaller, innovative, or niche consulting firms are often not included.

Official Website: https://www.gartner.com/en/documents/6808034

5. Forrester

Forrester is a globally recognized research and advisory firm that provides technology leaders with objective, data-driven insights. Its flagship evaluation tool, The Forrester Wave™, is a critical resource for enterprise buyers. The Wave provides a rigorous, criteria-based assessment of service providers’ capabilities, strategy, and market presence, making it an essential tool for technical and procurement leaders.

For CIOs and CTOs, Forrester’s analysis evaluates how a firm’s offerings address real-world enterprise challenges. Their consulting firms ranking methodology is transparent, with weighted criteria clearly outlined. This allows buyers to understand not just who leads, but why they lead in specific domains like Application Modernization, Multicloud Managed Services, or Cybersecurity, providing a solid foundation for strategic partner selection.

Key Features and How to Use Them

The Forrester Wave reports are designed to help buyers create a shortlist of the most viable vendors for their specific needs. Understanding how to leverage these reports is key to making an informed decision.

- Detailed Wave Evaluations: Each Wave report uses a transparent set of criteria to score vendors across their “Current Offering,” “Strategy,” and “Market Presence.” Use this to align a vendor’s strengths with your most critical project requirements.

- Vendor Positioning (Leaders, Strong Performers, etc.): The Wave graphic gives an immediate visual summary of the market. Dig into the accompanying vendor profiles to understand the specific strengths and challenges Forrester identified for each firm.

- Multiple Wave Reports: Triangulate providers by reviewing their performance across several relevant Waves. A firm that is a “Leader” in both Application Modernization and Public Cloud Managed Services is likely a strong candidate for an end-to-end transformation.

Practical Tip: Don’t just look at the “Leaders” quadrant. A “Strong Performer” or “Contender” may have a niche specialization or a more flexible engagement model that is a perfect fit for your organization’s specific needs and budget, especially for mid-market companies. Read the detailed write-ups for each vendor.

While Forrester is excellent for strategic vendor assessment, the detailed reports often sit behind a paywall, making it a tool for serious, well-budgeted evaluation cycles.

Platform Assessment

| Feature | Rating | Details |

|---|---|---|

| Data Quality | ★★★★★ | Based on rigorous, transparent, and criteria-driven analysis, including vendor briefings and client interviews. |

| Ease of Use | ★★★☆☆ | Public summaries are accessible, but navigating the full platform and accessing complete reports requires a subscription. |

| Cost | ★★☆☆☆ | Expensive. Full access to Wave reports typically requires a client subscription or a significant one-time purchase fee. |

| Focus | ★★★★★ | Highly focused on enterprise-grade service provider capabilities, strategy, and market performance. Excellent for technical due diligence. |

Pros & Cons:

- Pro: Actionable, criteria-based evaluations are directly aligned with the needs of enterprise modernization and operations teams.

- Pro: The reports often include a broad set of vendors, from large global systems integrators to specialized boutique firms.

- Con: The high cost of full reports can be a barrier for organizations without a dedicated research budget.

- Con: The timing and scope of Wave reports are set by Forrester, so a specific niche you’re interested in may not have a recent evaluation.

Official Website: https://www.forrester.com/blogs/introducing-the-forrester-wave-application-modernization-and-multicloud-managed-services-q1-2025/

6. IDC (MarketScape)

IDC is a premier global provider of market intelligence, and its MarketScape reports are a cornerstone for technology procurement. IDC offers a rigorous, data-driven assessment focused on vendor capabilities and go-to-market strategies. This makes it an essential resource for CIOs, CTOs, and sourcing teams who require an objective benchmark of a firm’s ability to execute and innovate.

For technology leaders, an IDC MarketScape report provides powerful, third-party validation of a consulting firm’s position. The four-quadrant visual, which plots providers as “Leaders,” “Major Players,” “Contenders,” or “Participants,” offers an at-a-glance understanding of the competitive landscape. This consulting firms ranking methodology is highly respected in procurement circles and can be used to build a credible, defensible shortlist for RFPs.

Key Features and How to Use Them

IDC’s value lies in its structured analysis, which helps decision-makers move beyond marketing claims and focus on proven performance and future direction.

- Four-Quadrant MarketScape Visuals: Use the quadrant to quickly identify the “Leaders” in a specific service area, such as cloud professional services. These are firms assessed as having both strong current capabilities and a robust strategy.

- Industry-Specific Nuance: Look for MarketScape reports tailored to your sector (e.g., financial services, healthcare). These provide crucial context on which firms have expertise in navigating your industry’s specific challenges.

- Benchmarks Across Capabilities and Strategies: Go beyond the visual to understand the scoring criteria. A firm might excel in “Capabilities” (execution) but lag in “Strategies” (innovation). This insight helps align a partner’s strengths with your project’s goals.

Practical Tip: Be cautious of vendor-hosted reprints of IDC reports. While useful, they can be abridged. When a firm is a critical contender, consider purchasing the full report directly from IDC to get the complete, unbiased analysis and detailed vendor profiles.

While IDC provides an excellent top-down market view, it is a starting point. It validates a firm’s market position but should be followed by direct engagement to assess cultural fit and specific team expertise.

Platform Assessment

| Feature | Rating | Details |

|---|---|---|

| Data Quality | ★★★★★ | Based on rigorous, structured research, including vendor briefings and customer interviews. |

| Ease of Use | ★★★☆☆ | Publicly available information is high-level. Accessing deep insights requires purchasing reports. |

| Cost | ★★☆☆☆ | Full reports are expensive, targeting enterprise budgets. Free excerpts offer limited value. |

| Focus | ★★★★★ | Laser-focused on vendor capabilities, market strategy, and competitive positioning. |

Pros & Cons:

- Pro: Highly credible and well-regarded by procurement teams, making it a strong tool for building internal consensus.

- Pro: Offers objective, data-backed analysis that cuts through marketing hype to assess true market leaders.

- Con: Full reports are costly, which can be a barrier for mid-market companies or teams with limited research budgets.

- Con: The analysis is market-level and does not provide insight into the quality of specific consultants or project teams.

Official Website: https://www.idc.com/MarketScape

7. Everest Group (PEAK Matrix)

Everest Group provides a rigorous, data-driven approach to evaluating service providers through its PEAK Matrix assessments. Unlike platforms focused on broad prestige, Everest Group drills down into the actual service delivery capabilities of firms. Its unique strength lies in its services-oriented analysis, evaluating firms on market impact, vision, and capability. This makes it an essential resource for leaders in regulated industries and procurement teams prioritizing compliance and operational excellence.

For CIOs and vendor management teams, the PEAK Matrix offers a clear visual framework for comparing providers. Firms are categorized as Leaders, Major Contenders, or Aspirants, providing an immediate understanding of their market position. This consulting firms ranking methodology is built on deep analysis of provider strengths, limitations, and investment roadmaps, giving a forward-looking perspective on a potential partner’s trajectory.

Key Features and How to Use Them

Everest Group’s PEAK Matrix reports are designed to support complex procurement decisions, offering granular detail that goes beyond a simple score.

- Category-Specific PEAK Matrix Positioning: Use the graphical matrix to quickly identify Leaders in specific service areas, such as Cloud Security Services or Private Cloud, to focus on firms with proven execution.

- Detailed Vendor Profiles: Each report includes profiles that outline a firm’s strengths and limitations. This qualitative commentary is invaluable for understanding why a firm is positioned where it is.

- Deep Dives into Sub-Markets: Leverage reports on niche areas like sovereign cloud or FinOps to find specialized expertise for projects with unique compliance, security, or cost optimization requirements.

Practical Tip: When evaluating a firm from the “Major Contenders” category, pay close attention to the report’s commentary on their strategic investments and recent client wins. A Major Contender on a strong upward trajectory can often provide more innovative solutions and better commercial terms than an established but complacent Leader.

Platform Assessment

| Feature | Rating | Details |

|---|---|---|

| Data Quality | ★★★★★ | Based on rigorous, data-driven analysis, RFI responses, and executive briefings. Highly respected for its objectivity. |

| Ease of Use | ★★★★☆ | The website is professional and well-organized. Finding specific reports is straightforward. |

| Cost | ★★☆☆☆ | Executive summaries are free, but full, in-depth reports can be expensive, often costing thousands of dollars per report. |

| Focus | ★★★★★ | Unmatched focus on service delivery, operational capability, and market impact in specific IT and business process domains. |

Pros & Cons:

- Pro: Granular, services-oriented evaluations provide a practical counterpoint to software-centric or prestige-based rankings.

- Pro: Often includes rare insights into pricing, delivery models, and a provider’s strategic investments.

- Con: The high cost of individual reports can be a barrier for ad-hoc buyers or teams with limited research budgets.

- Con: Coverage is highly specific, meaning you may need to purchase multiple reports to get a comprehensive view of a firm’s capabilities.

Official Website: https://www.everestgrp.com

Top 7 Consulting Rankings Comparison

| Item | Implementation complexity | Resource requirements | Expected outcomes | Ideal use cases | Key advantages |

|---|---|---|---|---|---|

| CloudConsultingFirms.com | Low — self‑serve tools and filters | Minimal internal time; still requires RFP validation | Evidence‑backed shortlists, pricing ranges, platform matches | Fast vendor shortlisting for cloud migration, FinOps, budget‑aware selection | Methodology‑driven rankings, 2,400+ reviews, ROI/quiz tools, transparent pricing & red flags |

| Vault (Firsthand) | Low — browse free lists or buy guides | Low cost for guides; HR/procurement time | Talent/culture and prestige signals; basic firm profiles | Recruiting, employer‑brand assessment, culture/prestige checks | Recognized brand, region/practice filters, affordable guides |

| Forbes | Low — free lists and filters | Minimal — free access to topline lists | Market‑perception rankings and category recognition | Market scanning, reputation benchmarking across industries/functions | Strong brand, peer/client survey input, category filters |

| Gartner | Medium — interpret Magic Quadrant visuals | High — subscription or report purchase; analyst briefings | Visual leader/challenger positioning with strengths/cautions to de‑risk programs | Enterprise RFP due diligence, board‑level vendor selection for large cloud programs | Authoritative MQ visuals, consistent methodology, vendor cautions |

| Forrester | Medium — read Wave scoring and criteria | High — reports typically paid; briefings/webinars | Transparent weighted scores, strengths/challenges for provider selection | Choosing partners for application modernization and multicloud managed services | Detailed criteria/scoring, actionable for modernization and run‑ops |

| IDC (MarketScape) | Medium — interpret four‑quadrant benchmarks | High — paid reports; advisory/sourcing support available | Capabilities & strategy benchmarks with industry nuance | Procurement and sourcing for industry‑specific cloud professional services | Procurement‑oriented benchmarking, industry‑specific insights |

| Everest Group (PEAK Matrix) | Medium — interpret PEAK positioning and write‑ups | Medium–High — many full reports paid; summaries available | Services‑oriented vendor profiles with strengths/limitations and pricing/delivery insight | Regulated industries, compliance‑focused buyers, managed‑services sourcing | Granular, services‑focused analysis; pricing and delivery model detail |

Making Your Final Decision: A Blended Approach to Ranking

A static, one-size-fits-all consulting firms ranking is not the solution. The ideal partner selection process is about identifying the right firm for your specific technical, financial, and strategic context. The key takeaway from this analysis is the power of a blended evaluation strategy.

Relying on one type of ranking introduces blind spots. A prestige-focused list might overlook a technically superior boutique firm, while a data platform might miss the nuanced insights of an analyst report. Your goal is to move beyond a simple leaderboard and adopt a more sophisticated, evidence-based approach.

Your Actionable Framework for Partner Selection

Use this three-tiered validation process to start broad and progressively narrow your choices, ensuring each stage is informed by a different, complementary perspective.

-

Data-Driven Shortlisting (The “What”): Begin with a data-centric tool like CloudConsultingFirms.com. Use its filters to create an initial, objective shortlist based on your non-negotiables: cloud platform certifications (AWS, Azure, GCP), service competencies (e.g., data migration, Kubernetes), industry experience (e.g., HIPAA compliance), and budget alignment. This step ensures your potential partners are technically qualified on paper.

-

Analyst Validation (The “How”): With your data-backed shortlist, turn to reports from Gartner, Forrester, IDC, or Everest Group. These analyst assessments provide the “how,” evaluating a firm’s ability to execute, its strategic vision, and its market presence. This is where you de-risk your choice, especially for large-scale enterprise projects. A firm appearing in a Gartner Magic Quadrant or Forrester Wave has been vetted for its stability and methodology.

-

Perception and Cultural Fit (The “Why”): Finally, layer in qualitative insights from perception-based rankings like Vault or Forbes. While not a measure of technical skill, these sources offer a valuable window into a firm’s market reputation and culture. This step helps you answer the “why” a partnership might succeed or fail. A firm with a culture that aligns with your own is more likely to integrate smoothly with your team.

Putting the Blended Approach into Practice

Imagine you are a CTO at a mid-market financial services company planning a sub-$500K Azure data platform modernization.

- Step 1: Use CloudConsultingFirms.com to filter for firms with Azure Gold Partner status, proven experience in the financial services sector, and project case studies within the $250K-$500K range. This yields a shortlist of six specialized firms.

- Step 2: Cross-reference these firms against recent Forrester Wave™ reports on cloud migration services. You discover that two of them are cited as “Strong Performers,” validating their execution capabilities.

- Step 3: For these final two contenders, review Vault’s rankings to gauge their company culture and client feedback, helping you select the partner best aligned with your internal team’s collaborative style.

This methodical triangulation of data, analyst insight, and market perception transforms selection from a guess into a strategic decision. You are no longer picking a name from a list; you are building a partnership based on a comprehensive understanding of a firm’s capabilities, reliability, and cultural compatibility. The ultimate consulting firms ranking is the one you create yourself, tailored to your organization’s unique needs.

Ready to build your own evidence-based shortlist? Starting with a strong data foundation is critical. CloudConsultingFirms.com is designed specifically for this purpose, allowing you to filter, compare, and analyze partners based on the technical and business criteria that matter most. Visit CloudConsultingFirms.com to start creating your personalized consulting firms ranking today.